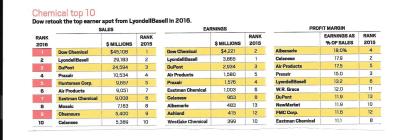

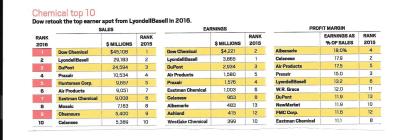

With little new in the chemical industry world [believe me, I have been trying to find some interesting (to me) developments]I have been reflecting on how the landscape of U.S. chemical companies has changed since, let’s say, the end of the last century. Several forces have been at work here, including consolidations, mergers and private equity. The above graphic, taken from Chemical & Engineering News lists the ten largest U.S. chemical companies in 2016. [Note that it does not include the chemical divisions of oil companies(e.g. Exxon Chemical) or foreign chemical firms(e.g. BASF, SABIC)].

With little new in the chemical industry world [believe me, I have been trying to find some interesting (to me) developments]I have been reflecting on how the landscape of U.S. chemical companies has changed since, let’s say, the end of the last century. Several forces have been at work here, including consolidations, mergers and private equity. The above graphic, taken from Chemical & Engineering News lists the ten largest U.S. chemical companies in 2016. [Note that it does not include the chemical divisions of oil companies(e.g. Exxon Chemical) or foreign chemical firms(e.g. BASF, SABIC)].

First, let’s speculate on why and how these firms have survived: Dow Chemical(almost went bankrupt after Rohm and Haas merger, then pushed for the forthcoming deal with DuPont); LyondellBasell(did go bankrupt due to excessive debt, but was rescued by private equity); DuPont and Dow (Survived private equity attack and are now merging with each other, then splitting; Praxair (Split off from Union Carbide, doing well since then, and in a comfortable oligopoly with Air Products and others); Huntsman(First private, then public company, takeover prevented by heavy inside ownership); Air Products(see Praxair, divested its chemicals to concentrate on core industrial gas business); Eastman Chemical (remained relatively unscathed); Mosaic ( Fertilizer company not of great interest as takeover candidate); Chemours( Fluorine- and Titanium-based businesses spun off from DuPont as a result of private equity pressure, not of great interest as takeover candidate; Celanese ( Spun off from Hochst, then taken over by private equity, then successfully relaunched).

Thus, private equity has had a large role in restructuring the industry, but that phase may be over. While not all of the following is apparent from the graphic, it is true that basic petrochemicals have been largely taken over by the petroleum companies, including the Middle East firms, though some “foreign companies” like Westlake, Shintech and Formosa Plastics keep making PVC here while ammonia and methanol-based petrochemicals, continue to be made in the U.S, . (Dow will eventually get out of basic petrochemicals except for its differentiated polyethylene. Fertilizers continue to be produced domestically, due to cheap shale gas, which also accounts for the rebirth of the U.S. methanol industry.

Celanese is doing outstandingly well. You could applaud the management of ex-CEO David Weidman and current CEO Mark Rohr for that. Three factors account for the company’s excellent performance. (1) Vertical integration back to methanol for much of its chemical and polymer portfolio, (2) Strong contribution from all four of its product sectors (Advanced Engineering Materials, Consumer Specialties, Industrial Specialties, and Acetyl Intermediates) and (3) Truly global sales diversification, including all continents. While Celanese’s products could largely be termed “petrochemicals”, they were mostly of the differentiated kind, allowing pricing power. And continuing research and development kept the company close to or ahead of its competitors. Eastman Chemicals has pursued a somewhat similar portfolio strategy, but at lower profitability

The current lineup of U.S. chemical companies may not change much, though its seems obvious that there are still too many firms in the Specialties sector.

As some of my readers have surmised, I developed a lifelong interest in the chemical industry. I started collecting chemical and petroleum/energy related stamps many years ago, joining a large contingent of collectors with a similar interest. At some point I bought the book illustrated above, which is absolutely magnificent. It illustrates many hundreds of topical stamps from countries all over the world with annotations. A wonderful way to reflect on chemical history in color.

As some of my readers have surmised, I developed a lifelong interest in the chemical industry. I started collecting chemical and petroleum/energy related stamps many years ago, joining a large contingent of collectors with a similar interest. At some point I bought the book illustrated above, which is absolutely magnificent. It illustrates many hundreds of topical stamps from countries all over the world with annotations. A wonderful way to reflect on chemical history in color.